Personal Exemption 2018 Philippines, Old Tax Rates Will Still Apply For Personal Income In 2017 Inquirer News

Personal exemption 2018 philippines Indeed lately has been sought by consumers around us, maybe one of you personally. Individuals now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of this post I will discuss about Personal Exemption 2018 Philippines.

- Senate Oks P250k Annual Income Tax Exemption

- New Income Tax Table 2020 Philippines

- Who Pays 6th Edition Itep

- Tax Calculator Compute Your New Income Tax

- Http Senate Gov Ph Publications Stsro 50 20 20taxbits 2048th 20january 20 20february 202018 Pdf

- Philippine Estate Taxes 2018 Lawyers In The Philippines

Find, Read, And Discover Personal Exemption 2018 Philippines, Such Us:

- Hiring Employees Guide In The Philippines Nnroad

- How Will Train Impact You Cloudcfo

- Train Series Part 4 Amendments To Withholding Tax Regulations Zico

- Pdf Income Tax Reviewer Jebmari Becaro Academia Edu

- Https Www Grantthornton Com Ph Globalassets 1 Member Firms Philippines Tax Alerts 2018 Rmc No 50 2018 Pdf

If you re looking for Chinese Thanksgiving Dinner you've come to the ideal place. We have 104 graphics about chinese thanksgiving dinner including images, photos, photographs, backgrounds, and much more. In such webpage, we also provide number of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

With The Passing Of The Ra 10963 Train Autism Society Philippines Facebook Chinese Thanksgiving Dinner

Lower tax rates for professionals.

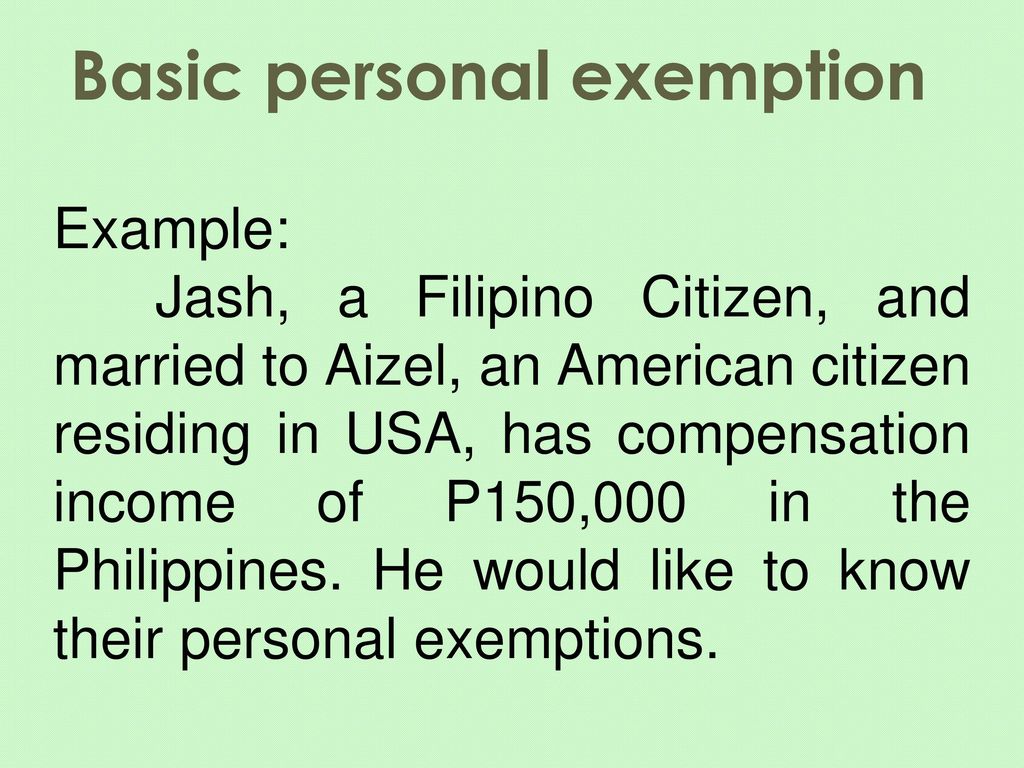

Chinese thanksgiving dinner. Singlewidowwidower individual or married individual judicially decreed as legally separated with no qualified dependent. In addition the new bir tax reform removed the monetary exemptions enjoyed by taxpayers in the old system. Hereunder are the requirements of a qualified dependent child.

On or before the 15th day of april of each year covering taxable income for calendar year 2018 and thereafter return to index. For each married individual. This tax withheld shall be filled monthly and remitted using bir form no.

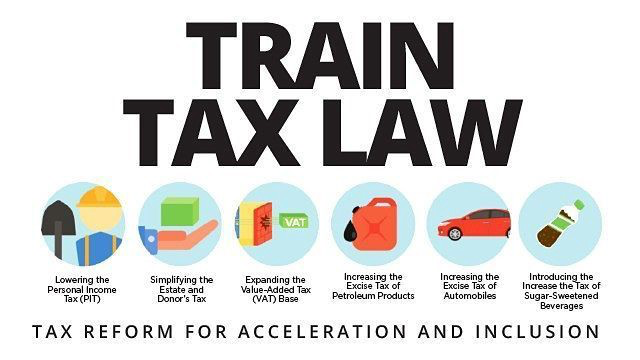

Personal exemption of p50000 for. Originally angara pushed for a a p150000 exemption including workers earning p250000 with 4 dependents. There are many changes made on personal income tax because of this new reform tax law.

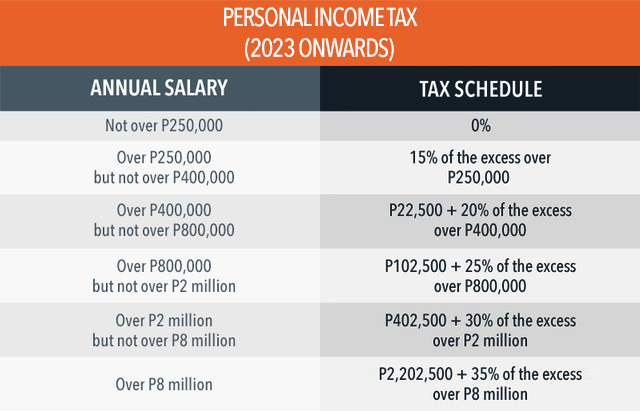

Personal income tax rates will be lowered while salaried employees earning annual income of p250000 or below will be exempted from paying income taxes. To know your personal income tax you may read on how to use the tax calculator. Additional exemption of p25000 for each dependent child not exceeding four in the case of.

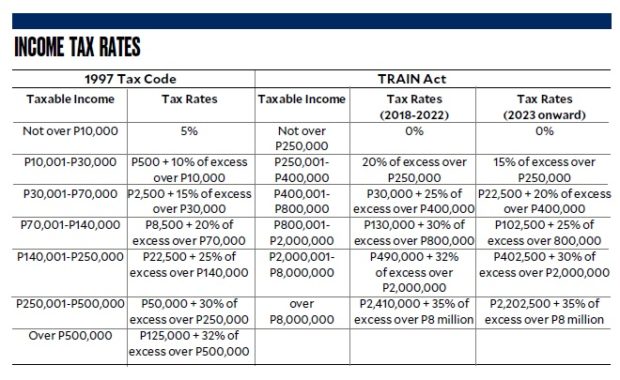

Full details of the new personal income tax rates and income tax tables can be found here. In the computation of annual income tax for income tax return filing in the philippines this p5000000 basic personal exemption in the philippines is deducted from gross income additional personal exemptions ape this is a mandatory deduction of p2500000 for each qualified dependent child up to maximum of four 4 qualified dependent children in the philippines or a maximum amount of p10000000. Further additional exemptions of individual.

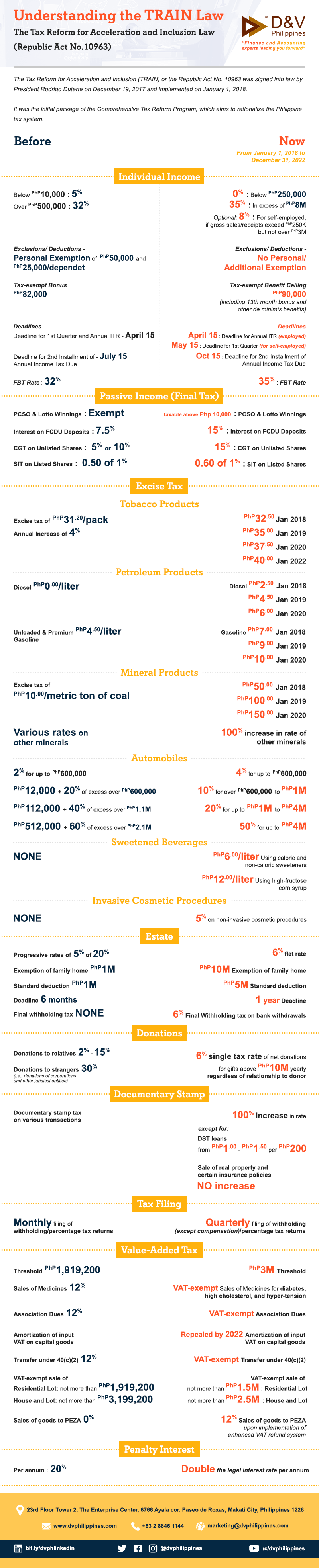

Resident citizens receiving income from sources within or outside the philippines. Php 50000 for personal exemption and php 25000 additional exemption per qualified dependent deleted individuals not required to file income tax returns itr. 2 starting january 1 2018 compensation income earners self employed and professional taxpayers seps whose annual taxable incomes are p250000 or less are exempt from the personal income tax pit.

Married individuals only one of the spouses can claim the additional exemptions. However the p25000 exemption per dependent for up to 4 dependents or a maximum of 100000 per taxpayer was removed. Under the first package of reforms that took effect on jan.

The personal exemption amounting to p50000 and additional exemption of p25000 per qualified dependent maximum of p100000 additional exemptions for a taxpayer with four 4 dependents are now gone in the train law. Tax schedule effective january 1 2023 and onwards. He then amended it to propose a staggered income tax exemption.

Revised withholding tax in the philippines 2019.

More From Chinese Thanksgiving Dinner

- Thanksgiving Turkey Soap Dispenser

- Bobby Flay Thanksgiving Show

- Bigg Boss 4 Tamil Voting Results Today

- Johnny Depp Movies List In Tamil Dubbed

- Life Healthcare Logo Png

Incoming Search Terms:

- Answer Key Tax Docx Jpia Review Individuals 1 Lj Married Left The Philippines In The Middle Of The Year On July 1 2018 To Go Abroad And Work There For Course Hero Life Healthcare Logo Png,

- The Complete J1 Student Guide To Tax In The Us Life Healthcare Logo Png,

- Compute How Much Taxes Will Be Deducted Monthly Under The Train Law Life Healthcare Logo Png,

- Philippine Tax Calculator Taxumo File Pay Your Taxes Online Life Healthcare Logo Png,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcrfikstqrx2lahoeklp Pnxozeyj0nvyevzubbyilakhmhm38qx Usqp Cau Life Healthcare Logo Png,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcq7sjic4ag3biti4gmsn4pr6tcowzcrcrird Lr2ikm46sfv7rl Usqp Cau Life Healthcare Logo Png,